Although selling a home generally means increasing income for the property owner, it can be an extremely tiring and challenging process. Various expenses may be required to speed up sales and ensure that the property attracts buyers in a short time. In addition to the property price, the buyer has to spend out of pocket for many documents and official transactions. Sometimes the same is true for the landlord. For this reason, knowing what kind of expenses will be incurred before the house sale, which is quite troublesome, and making preparations accordingly helps to plan the process much better. It also means you get permanent references for the future as a real estate agent.

- Renovation Expenses

Most property owners want to put the house up for sale without renovating it, but especially minor renovations will help both speed up the sales process and increase the value of the house. For this reason, you can inform your customers about the status of similar advertisements around you and warn them to allocate a budget for renovation, and you can offer a new pricing for the house according to the preliminary costs to be incurred. You can remind your customers that these expenses they will make out of their own pockets are an advantage during the sale, to sell their house quickly and make more profit.

Subscribe to Fizbot Newsletter

Sign up for our newsletter to read more content from Fizbot, leading the industry by using the power of data!

- Capital Gains Tax

Taxation in accordance with the regime-rule of taxation applicable to non-tax residents, i.e. taxation of 100% of the capital gain ascertained, at the special rate of 28%; in the case of residents of a Member State of the European Union or the European Economic Area (in the latter case, provided there is an exchange of information on tax matters), taxation of 50% of the capital gain, at marginal tax rates (which currently vary between 14.5% and 48%), plus the additional solidarity tax (currently up to 5%). Same for Portuguese citizens.

You avoid this tax if:

– You owned the property before January 1st 1989;

– The building was for personal and permanent housing, and you will reinvest on buying another personal and permanent property within 36 months

- Real Estate Agency Tax (if you resort to one, in Portugal 5%+VAT)

- Mortgage Cancellation fee (if used in a loan to pay for the house, price defined by the bank)

- Documentation Expenses:

- Permanent property certificate – Only in apartments 15€ (online price) per fraction (valid for 6 months);

- Duplicate License of Use – starting at 35€ (increases with the number of pages, for houses built after 1951);

- Duplicate Technical Document of the House – starting at 35€ (increases with the number of pages);

- Energetic Certification – starting at 130€ (increases with area of the house added to the expert fee)

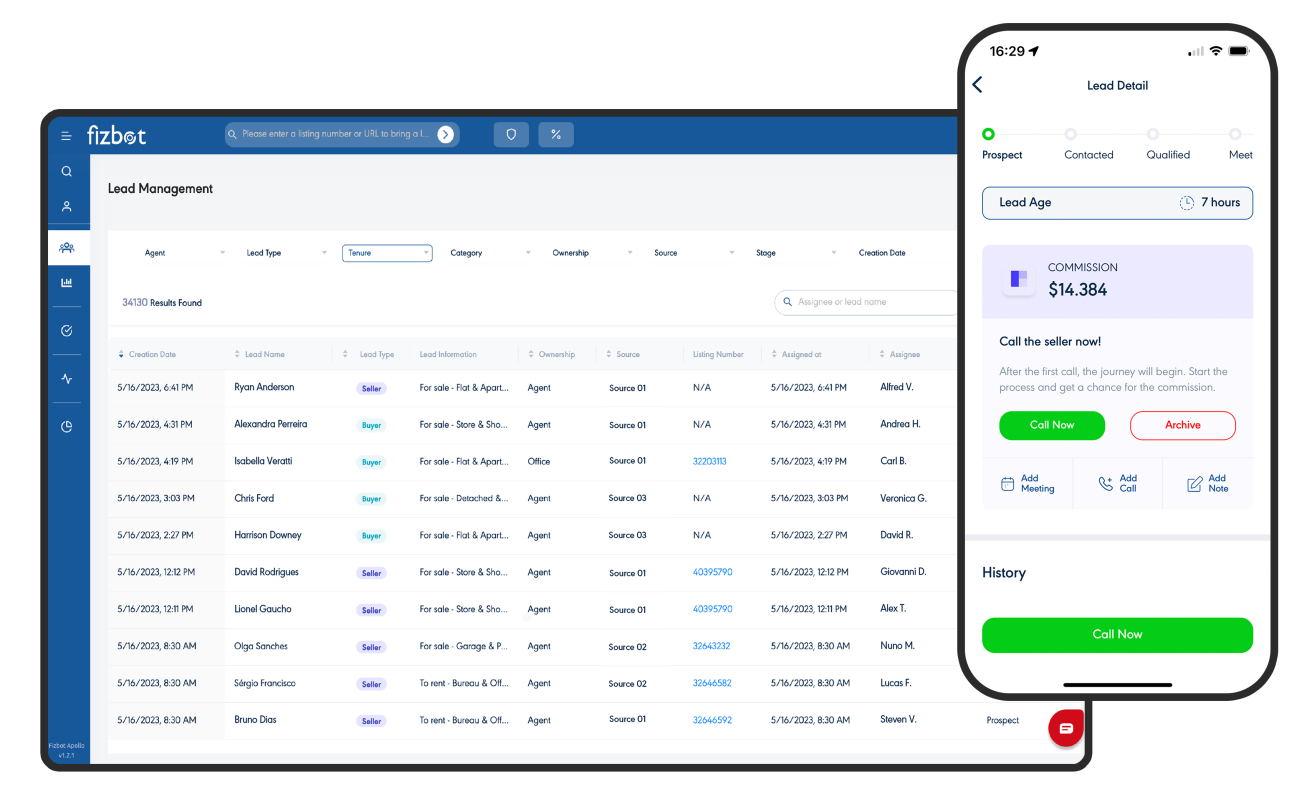

As an expert real estate agent, you should inform your customers about the additional costs that may arise in the sale of housing. Knowing in advance what kind of payments will be made, including the realtor commission fee, both increases the confidence of the other party in you and prevents unexpected transactions from occurring. Fizbot real estate consultant software, which accelerates your services at every moment of the housing sale, helps the process to proceed smoothly.

If you want to join the new generation digital real estate consultant Fizbot world and follow the trends in real estate closely, you can reach us here .

Português

Português Română

Română Türkçe

Türkçe